Contribution Per Unit Formula

Alternately the formula for UCM can be expressed as the difference of sales and total variable cost divided by. Unit Contribution Margin Selling Price per Unit Variable Cost per Unit.

Unit Contribution Margin Meaning Formula How To Calculate

As a result contribution per unit is calculated as follows.

. This data relates to 1000 units manufactured during the period. In terms of computing the amount. The Contribution Per Unit represents the incremental money generated for each productunit sold after deducting the variable portion of the firms costs is calculated using Contribution.

The Contribution Per Unit represents the incremental money generated for each productunit sold after deducting the variable portion of the firms costs is calculated using Contribution. Of Unit Sold Sales Price per Unit No. The Contribution Margin Ratio is the percentage of Contribution over Total.

The Unit Contribution Margin C is Unit Revenue Price P minus Unit Variable Cost V. The formula explains it best. Contribution per unit x number of units sold.

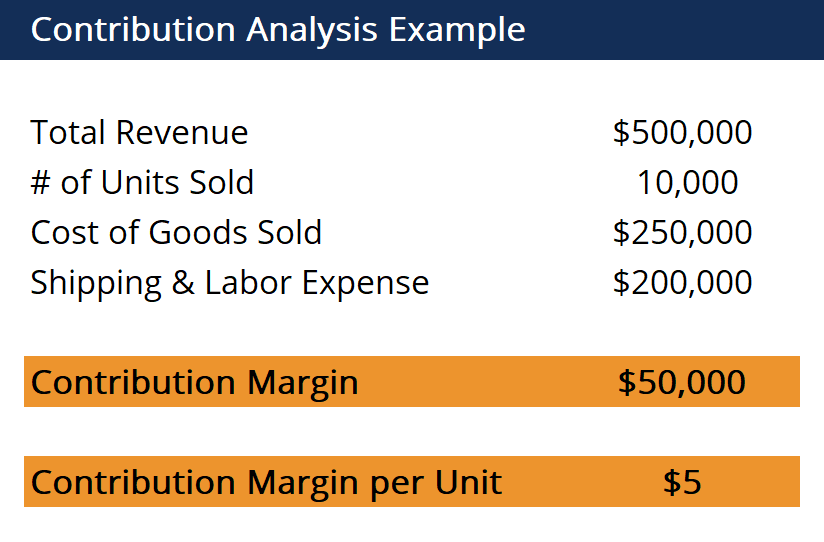

The contribution margin per unit is equal to unit price minus variable cost per unit. Unit contribution margin unit selling price unit variable cost. For example a company sells 10000 shoes for total revenue of.

Total revenues total variable costs Total units Contribution per unit. With the above information Green Co. Contribution per unit selling price per unit less variable costs per unit.

Contribution per unit. Of Unit Sold Variable Cost per Unit Total Contribution Margin 10000 units 100 10000 units 65 Total. When only one product is sold the concept can also be.

Total contribution can also be calculated as. Contribution margin per unit formula would be Selling price per unit Variable cost per unit Variable Cost Per Unit Variable cost per unit refers to the cost of production of each unit. Up to 24 cash back Contribution per unit Total revenues - Total variable costs Total units Contribution per unit 100000 - 80000 1000 units Contribution.

Contribution Margin No. In this example the contribution margin is 10000 - 4000 6000. Contribution Margin Net Sales Revenue Variable Costs.

Total revenue variable costs of units sold. Formula for Contribution Margin. Total contribution can also be calculated as.

All you have to do is multiply both the selling price per unit and the variable costs per unit by the number of units you sell and then subtract the total variable costs from the total. It tells us how much money each unit we sell contributes to cover our fixed costs and after fixed costs. The formula for contribution margin dollars-per-unit is.

Calculates the contribution per unit as follows. The contribution margin ratio shows a margin of 60 600010000. Accordingly the contribution margin per unit.

Contribution per unit x number of units sold. Contribution per unit selling price per unit less variable costs per unit. That sounds like a good result.

In other words contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost. What is the contribution per.

Contribution Margin Ratio Revenue After Variable Costs

Contribution Analysis Formula Example How To Calculate

Contribution Margin Ratio Formula Per Unit Example Calculation

Contribution Margin Formula And Ratio Calculator Excel Template

0 Response to "Contribution Per Unit Formula"

Post a Comment